Message Thread:

Messy, messy topic. Gender. Roll up your sleeves, let's do this.

3/23/15

Okay, I know. It's a hard topic. But I gotta know, and I'm tired of messing around in theory, anger, and political correctness. I just want to know--what am I really facing?

So I can't decifer, for the life of me, if this a real problem or not. I think that everyone in the world faces some sort of animosity. I also think that it is unfair to say "I fit this demographic background and I suffer", Everybody suffers. Small man, insecure man, softspoken man--everybody suffers in trades. And everywhere else, really. Way more than I do, I've seen it.

So here is the question--hearing your whole life that you are a woman and you will not be taken seriously does play a toll on you, even if you are strong. In stupid ways really, because I have never been met with any real stops from gender. If anything, I've gotten a ton of "underdog" cheering and praise.

Most people would say I'm crazy to ask a bunch of american middle aged business men this question--but I'm not in it for a fight. I actually want to know what's going on.

I want to know if I am being pushed to seeing this bigger than it is, or if it really is an issue.

Any thoughts? Please don't be afraid to express yourself, I'm truly not looking for a fight, or will ever reprimand honnesty. And any gender assumptions will not be viewed as a personal attack. Lets all relax and crack this cookie-- I've been stuck alone with this question for way too long.

3/23/15 #2: Messy, messy topic. Gender. Roll up ...

Hah! Too funny, I thought the thread had been removed but I simply posted it to the wrong dept--should be in business.

So to elaborate a bit, as I know it's a scary topic... This is my experience. Don't know if it represents much, but I think it's still interesting.

I think we are at a point in time where this situation is really quite manageable. I started out in trades as a steel scaffolder. No one messed with me there-- they saw me slinging steel like a madwoman for 2 to 20 hours a shift, depending. I don't care what you look like, if you can do that, no one says squat.

At the cabinet shop--a bit of a rocky start. Guy following me around to lift stuff for me, a 60 year old morbidly obese man seriously asking me out on a date, and another sneaking in super sleazy comments at quick paced pass-bys.

I had a bit of a stutter, a wtf is going on period, but stopped and thought for two seconds about who these humans were.

Most of them for sure had very limited exposer to women, let alone one in my sort of background/demographics, and that close to them. I figured out that they needed to be taught how to deal with my being there. Each one required a different approach, but now we are there. Fully. No leering, no expectations, no creepy comments, no bs.

And I can't even say it took that long, especially considering that this is a very redneck place, and those guys are definitely older and more use to their patterns. But a bit of compassion and a whole lot of patience seems to have worked wonders.

Wish I knew this stuff earlier. I remember being fresh out of college and having touched on social theories on this. It was mostly represented as some sort of a big conspiracy theory where evil was looming and the dominators tormented the dominated.

My experience is showing me that it really isn't always the case. But again, not pretending I have the answer, just pondering.

3/24/15 #3: Messy, messy topic. Gender. Roll up ...

So, you are asking if we take you less seriously?

3/24/15 #4: Messy, messy topic. Gender. Roll up ...

Mel,

A scientific approach to this problem would be to divide all women into three possible groups:

Group 1 consists of those women who can't walk down the sidewalk without continual, pervasive, predictable harassment by the opposite sex.

Group 2 consists of those women who have never experienced any kind of harassment at all in the workplace or elsewhere. Men never notice them or if they do never manifest this.

Group 3 are those women who fall somewhere in the middle. They get their share of unwanted attention but on the other hand some of these guys are kind of cute and funny too.

If women had to select the group they prefer to belong to what do you think the bell curve would look like?

3/24/15 #5: Messy, messy topic. Gender. Roll up ...

My experience in the trades has been that everyone is taken at face value, and judged primarily by how well they work. I've had women on my shop floor who worked hard, had good skills, and didn't seem to have any problems (as far as I knew.) But I'm the boss, I hired them, and so there was no reason for me to feel threatened by them. I have no idea whether the women would tell a different story, but nobody every complained to me about discrimination.

3/24/15 #6: Messy, messy topic. Gender. Roll up ...

It has always struck me that the "minorities" that have problems make them worse by walking around with a chip on their shoulder and trying to be "different/special." We've almost always had at least one woman in the shop. To tell the truth women that work in this kind of place are usually "different." They don't try to come across as "girly." I can only remember one that had any issues fitting in. She displayed her abundant "talent" by the revealing clothes she wore and then complained about the reactions. She quit and got a job in a bar.

3/24/15 #7: Messy, messy topic. Gender. Roll up ...

What exactly is your question?

3/24/15 #8: Messy, messy topic. Gender. Roll up ...

In reality this is a straw man argument. The idea was tacitly planted in your skull, and you probably did not realize it because it occurred in a microsecond. E.G. I was helping a buddy build a cabin many moons ago, a commercial for budweiser came on the radio, it said "for all you do this bud is for you", without even thinking I went into the cooler and grabbed a beer. My friend said that commercial sounded good to you, huh? And i realized that is how this stuff works.

In the 30s contractors would bring workers up from the south who would work cheaper, they were black. The unions objected because it put their union workers out of work.

So they lobbied for the Davis Bacon act AKA prevailing wage. This curtailed cheaper work being done by the black workers. Along with this law was a subtle message that black workers were not as good. Before Davis Bacon was enacted black unemployment was lower than white unemployment. Since Davis Bacon black unemployment has been much higher. The reason for this is not just Davis Bacon it is a host of other laws(minimum wage is one of them) and regulations that had unintended consequences. IOW this was a case of a subtle and not so subtle straw man argument. The way I found out about this was by reading a book by a black economist named Thomas Sowell.

Then we got into the Gloria Steinem era. Proclaiming that women were being exploited. Thomas Sowell also indicated in his book that if a woman works as many hours as a man she makes slightly more than a man. But that statistics indicate that women have a pension for working fewer hours as in part time work or taking time off to raise children. This also puts women behind because they fall behind in changes in technology. Women tend to work in fields that are more stable for this reason. But in reality women are not exploited in the market place.

I think a lot of this stuff is started by people who stand to gain something from creating the straw man argument and people do not realize they have tacitly adopted this sort of thinking.

3/24/15 #9: Messy, messy topic. Gender. Roll up ...

Cool, thanks for stepping up folks.

It is a straw man argument, isn't it? I don't know, the noggin gets tangled sometimes.

It probably feels clearer from your standpoint, but I'm sometimes unsure, perhaps because I don't have the picture that distance brings.

I see no real problem really, but then thinking gets muddled by the fact that the whole world wants to tell you there is one. The commities that want you to go to talks about it, the public announcements, the school with their female specific trades programs, the gender studies, and even the assumptions, not from me, I assure you, but from others, that any uncomfortable situation was the result of some sort of bigotry.

I actually think my world is kinder then that. All I see is occasional awkward momments that derive from way more base/primitive/normal human condition, and that is just life, and not really the target of any "group". Everyone gets their share of that one.

Jim C, lol-- smarta$$ :) It is just a question. I think about a whole lot of strange things, and this one pops up here and there. I think it's a fair one to ask. You don't get answers if you don't ask questions.

Thanks again for responding-- I half expected to have no one want to touch this one, out of some sort of PC bs or something.

3/24/15 #10: Messy, messy topic. Gender. Roll up ...

What about the ceiling and lack of respect for morbidly obese men? Couldn't help myself Mel, when you are asking about respect in your field, then you judge and describe that guy by his size. Never worked with a woman in the woodworking field, but did in my first job as a draftsman. First gal hired there was hired because she was a gal and gender quotas had to be met. She had no skills, had to borrow other people's equipment, really put out some low quality work, and didn't care. I had no respect for her at all. As stated, represent yourself with your skills.

3/25/15 #11: Messy, messy topic. Gender. Roll up ...

Sorry if I touched a nerve there, Rich. No evil intentions, promise.

I'm not stating I have no prejudice, that would be foolish. But I do like hard questions anyway.

I think there is a difference between work and sex. Work along side a morbidly obese man? No problem. Don't care. But ask me out on a date as a morbidly obese man, who is older than my father, and has met my husband several times, works accross from me all day every day---it's a little bizarre. Not the end of the world, but brings a bit of "holy crap! What did you think up??" to the table.

Maybe I'm a big huge biggot? If so, you let me know. Trust me, I'd work on it.

3/25/15 #12: Messy, messy topic. Gender. Roll up ...

One thing that nobody has mentioned yet is pay. Are women getting equal dollars for equal work? Hard to say. Here's a relevant article from a different field:

Stubborn Pay Gap in Nursing

3/25/15 #13: Messy, messy topic. Gender. Roll up ...

Despite generalities, the micro environment of each shop wil be unique. Introduce a woman into the shop and the most important first quality has to be confidence, with either skills or readiness for skills a close second.

It takes confidence to bust out a bunch of usable parts from rough lumber and come up with all usable stock. If a person can do that, and do it well, gender doesn't matter. Now there is nothing wrong with learning it, if that is the way the hiring was done, but that learning also must be done with confidence.

We have all had the experience of the first days on a job, where we are awkward and unsure. But once we get the lay of the land, we can ramp up quickly and become productive.

While there are undoubtedly some people that would never accept a woman in the shop (and I have worked for more than one that said that very thing), a woman, or man, that comes into the shop and gets productive, asks good questions, and pulls their weight should find no problems fitting in with no special considerations.

I will add that 45 years ago, this question would never have been asked. That alone is a sign that things are changing, and equality is more prevalent today than yesterday, and will be better tomorrow.

3/25/15 #14: Messy, messy topic. Gender. Roll up ...

Out of a crew of 13, I have 5 who are women. Don't ask them to do more nor less than any of the guys. Some people (male and female) cannot do some of the jobs due to physical limitations.

I have a very wide range of people who work for me. I have people who are physically disabled so they are not as not as mobile as others. I have several who spent years in prison. I have some that are recovering addicts from drugs and/or alcohol. I have some that are stay-at-home parents looking for part time work while the kids are in school. I have a few retirees wanting a few hours but don't want to work at McDonalds nor Walmart. I have a few full time people as well.

Expect everyone to pull their weight and make their numbers for production. If they don't, then they don't work here anymore.

Have had in the past, guys who would try to hit on the girls but we let them go as that is not the type of behavior that I want here. People are friendly to each other as I try to foster an environment where we are all in this together, no matter what your postion is.

3/25/15 #15: Messy, messy topic. Gender. Roll up ...

The shop environment can be a strange place. Shop guys pick up patterns of behavior, even when it's all guys. There is pecking order, territorial attitude, and personal baggage. Been doing this for a long time, and have had only a handful of women in the shop. It hasn't worked very well, I avoid it. 2 observations is that #1 the ladies don't seem wired (mechanical aptitude) the same as guys, and #2 there is an undeniable effect of having the presence of a woman on the shop floor. The dynamics change. We hired a woman years ago, the guys were cute. They cleaned one of the bathrooms, and designated it to her, and the guys used another bathroom. They threw out all the Penthouse magazines. Some dressed better. She was nice, no personal problems, but mechanically not sound. I was worried that she would get hurt. I worked with her, and had the foreman work with her on the table saw (she had lied about her skills). Sure enough, she was doing a little project, had a kickback, broke her thumb, I fired her, she sued me. It was small, workers comp covered it, but stressful anyway. Another lady, big boobs, stood way too close all the time, and I finally bumped into her one day (honestly, by mistake)! The first thought I had was sexual harassment! She was the same as the first, lied about her abilities, I was worried she would get hurt. I let her go. And work gets done slower while the guys keep an eye on her, flirt with her, help her, etc. I could go on, but my point is that a woman on the shop floor doesn't seem to be a good fit. Please know that I am very comfortable around women, 2 daughters, 3 grand daughters, 3 nieces, a beautiful wife. I've overheard more 'girl talk' than than you can imagine. Buy-the-way guys...we don't stand a chance!

3/25/15 #16: Messy, messy topic. Gender. Roll up ...

This is a response. Like I said earlier, We've almost always had at least one woman in the shop. Don't get many applying. As for LYING about or maybe simply exaggerating their ability, so do most men, it is natural. It is up to the interviewer to determine the significance. You probably are at greater risk of litigation hiring a woman, but that's not the individuals fault.

Mechanical limitations, yup, but that is not limited to females. Not everyone has the same abilities, put people where they can feel comfortable and provide benefit tot he shop.

Subject of = pay. When hiring, pay is based on several things but probably the most relevant are verifiable skill & attitude. Both very difficult to determine from an interview. Work history can help but only if I can verify it with someone I trust. Attitude is probably displayed differently in the interview mode than real life. There are questions that can be asked to lead someone into revealing things that would not normally be directly answered.

I think most of the sex issues are controlled by the way management handles the shop "atmosphere." If you want to see sex issues in the work place talk to someone that works in a large office environment. Some things are just natural to animals of all kinds.

3/25/15 #17: Messy, messy topic. Gender. Roll up ...

Paul Downs:

"One thing that nobody has mentioned yet is pay. Are women getting equal dollars for equal work? Hard to say. Here's a relevant article from a different field."

(I did?)

From the article:

“We now have pretty compelling evidence that there are pay inequalities between men and women in nursing over the past 25 years,” said Debra J. Barksdale, the director of the doctor of nursing practice program at the University of North Carolina at Chapel Hill, who was not involved with the new study."

Yet the author, in the same article states:

"The study did not address reasons underpinning the persistent gap. There could be several reasons, Dr. Muench said: Men may be better negotiators, for instance, or perhaps women more often leave the work force to raise children. Women may have a tougher time getting promoted, she said."

Thomas Sowell does address the reasons underpinning the persistent gap.

IOW this article is the anatomy of a straw man argument. It shows who gains from creating the argument and it shows how assertions are tacitly accepted without evidence.

3/25/15 #18: Messy, messy topic. Gender. Roll up ...

Didn't hit a nerve Mel. Just didn't have all the information you gave me latter. Didn't know your age or marital status.

3/25/15 #19: Messy, messy topic. Gender. Roll up ...

I'm growing up a bit again :)

So I had a couple thread inspired epiphanies while sanding today.

1) I'm a biggot.

-applicable thread quote (from Rich C):

"What about the ceiling and lack of respect for morbidly obese men? Couldn't help myself Mel, when you are asking about respect in your field, then you judge and describe that guy by his size."

Actually, I did something way worse then that. I categorized you folks as "middle aged american business men"--as if that meant something. Which is pretty ignorant--I've gained substantial growth not just as a professional, but as person, bouncing thoughts off on this site and getting some sizable food-for-thought. People here are undeniably varied, and carry a whole range of ideas and opinions.

Seriously, wtf? I should know better. I'm also left with the question, how did I get there? I'm actually a pretty happy/loving person, just a little spun sometimes. Where do these uglier tangeants come from?

2) These ideas can get planted by benign seeming sources (not disallowing for sheer stupidity, which I am not immune from).

-applicable thread quote (from Pat G):

"In reality this is a straw man argument. The idea was tacitly planted in your skull, and you probably did not realize it because it occurred in a microsecond. E.G. I was helping a buddy build a cabin

many moons ago, a commercial for

budweiser came on the radio, it said

"for all you do this bud is for you", without even thinking I went into the cooler and grabbed a beer. My riend said that commercial sounded good to you, huh? And i realized that is how this stuff works."

Did I ever chew on this one today. I'm not even sure I'm done with it yet. So if I look at things--as mentionned, I started out as a scaffolder. No thoughts about gender as a social problem then. Simple thing--22 years old, more energy than anyone can handle, and no preconceived notions about people in my way. I just worked, had a ball, felt pretty happy, didn't question a thing.

Now I'm wondering--what changed? What happened between scaffolding and wood working? Trades school happened. There is where I heard the loudest rhetoric on gender, ever. Like pretty in-your-face loud.

This is long, but follow me please on this one...

I'm reminded of the movie Pi. The movie represents it better then I could, but here is the gist-- imagine you start focusing on the number, say, 17. You start seeing it everywhere. 17 steps to your friends appartment, your neighbor's som is 17, 17 milk jugs in the fridge at the corner store... You could see it all day.

Now here is the pickle--you've made 17 way more meaningful than it actually is. But lets not forget that 17 is still there. The inflated meaning/pattern is the human error in induction. To make this even worse--maybe there is actually something meaningful about 17. Like the seemingly random number of Pi, right?

Gawd I hope I don't end up putting a screw gun to my head like that guy ;)

3) There is in fact a bottom line result for a school to plant this sort of seed.

-applicable thread quote (from Pat G again, same post):

"I think a lot of this stuff is started by people who stand to gain something from creating the straw man argument and people do not realize they have tacitly adopted this sort of thinking."

So why? was my next question... (I'm a menace to society when I sand for too long) Answer is easy. You run a trades school. You're business is collecting tuition. Now if trades is male dominated, and you sell trades tickets, why not increase your market by the other half of the population you weren't accessing?

Not to take everything away from these initiatives--there are a good amount of women out there raising kids on minimum wage who could do/use a higher paying trades job. And that is a thing of beauty to bridge the gap a bit.

Perhaps I'm an adverse effect? Dunno. It's a big ol' tangle in the ol' cerebrum. But do I feel a little closer to actual reality. Not there yet, but closer. Thanks for endulging--I'll admit this one has really been on my mind.

3/25/15 #20: Messy, messy topic. Gender. Roll up ...

Oh and on salary--through the "what am I worth" thread and a local salary analysis and hearing what other people were paid where I work, I found out that I'm actually doing pretty good. Not screaming, but better than lots.

Same thing at my last employer. But I'm also pretty ballsy (Hah! Pun intended!) at salary requests. Is it a question of money being kept or of requests not being made? That question is bigger than me probably.

Other tidbit--on mechanical aptitude... I read mechanical engineering articles for fun (how twisted is that). I've fixed aspects of machines that have been out of whack for years before I started at my work. I fix my own truck. Not sure this a one rule fits all, just saying. It seems like it may be relevant.

3/26/15 #21: Messy, messy topic. Gender. Roll up ...

Yup, it is one of them blue pill red pill type deals.

Keep it simple which it is. Always follow the money. Conflict is almost always caused by a 3rd party. Keep your own council, IOW make sure your thinking is organic to you. Make sure the predicate supports the subject, (logic).

E.G. a couple is getting a divorce. Who is after the money? Who benefits from the conflict?

A war gets "started", who benefits from the conflict, who makes money from the conflict?

If it isn't obvious the answer is defense contractors.

The average American is functionally illiterate let alone skilled in logic. So it is no wonder things are going to hell.

Tim used to post excerpts from a machinist writings from the 1800s, it is amazing how well written and ostensibly literate they were back then. And even more amazing how illiterate we are now with an attention span to match.

3/26/15 #22: Messy, messy topic. Gender. Roll up ...

Pat, it's funny (I hope for you too, cause this ain't a bad thing), but I have to admit that sometimes you come off as a bit of a prick in text. But that post of yours has got me on a hell of a good mind bend, and I'm really happy about it.

Long story short--hey buddy, you're pretty good shit.

So follow the money... It seems like some sort of disgusting capitalist decandence sort of thing, but I think you are on to something that is larger than that. Let's cut it up a bit, to make sure I got it right?

So money is just paper, they say. But then humanity has always had some sort of equivalent of money. Chocolate, spice, fancy found shells, you name it.

But the idea is always the same--- You make a trade mark gauge for value. And value is gauged by need. I don't care how fundamentally f'd up the need is--if it has value, it represents the time.

So following the money--not sure anymore if it's f'd up capitalist greed, or a narrowing down of tasks.

Thoughts? I'm paying attention.

3/26/15 #23: Messy, messy topic. Gender. Roll up ...

"I have to admit that sometimes you come off as a bit of a prick in text."

A lot of people would agree with you, in person also... I think it is peculiar to the commercial construction industry...

"So money is just paper, they say. But then humanity has always had some sort of equivalent of money. Chocolate, spice, fancy found shells, you name it."

Yup as long as the next guy has confidence that he can take your money and trade if for something else.

"And value is gauged by need."

Sort of. Value is established by the two parties exchanging goods. Of course the value can be highly manipulated by adding cheap money to the process. E.G. an education is valued, so they start programs that make scholarships and student loans ubiquitous and all of a sudden the cost of an education is very expensive. Or you do the same thing with home loans and you get the same result. Or you do the same thing with the stock market and you get the same result. Or you do the same thing with health care and you get the same result.

"So following the money--not sure anymore if it's f'd up capitalist greed, or a narrowing down of tasks."

That is once again a straw man argument. If you follow the money all the way to the top you will arrive at the Mt Sinai of money AKA the Federal Reserve Bank. Not to be confused with a conspiracy this is out in the open and factual.

The dubious nature of the Fed is at the core of most of the problems we face.

3/26/15 #24: Messy, messy topic. Gender. Roll up ...

"If you follow the money all the way to the top you will arrive at the Mt Sinai of money AKA the Federal Reserve Bank. Not to be confused with a conspiracy this is out in the open and factual."

That!!! Not sure I fully get it, but it does worry me.

So here's what I got: everyone runs on money. Money gets printed by machines. The people in charge of printing that money are a privately owned operation.

Not that I really trust anyone to just print money, but hells, privately owned in USA??? How the hell is everyone not a little worried?

And sure as shit, this has nothing to do with conspiracy-we're not talking chem trails here. This is full blown happening.

Lol---gender based social issues are definitely not as worrisome as this. Perspective, eh?

3/26/15 #25: Messy, messy topic. Gender. Roll up ...

"So here's what I got: everyone runs on money. Money gets printed by machines. The people in charge of printing that money are a privately owned operation. "

Not really that is another straw man argument.

It is not quite as insidious as you might think. It is really just done by inflation. Inflation benefit investors and hurts Joe six pack. The mechanics are simple.

Inflation is caused by an increase in the money supply. There are NO other causes of inflation.

Inflation does not occur across the whole economy at once it starts closest to the money supply, which is the big banks and the investment companies.

The cronys (cool kids) who are closest to the spigot get access to the money first. This allows them to invest this cheap money (they pay very low interest rates on this borrowed money) in the stock market or real estate before the herd (us) have access to this flood of money. By the time the herd invests in the stock market and real estate (in some areas) the value of the investments goes up, lately a lot.

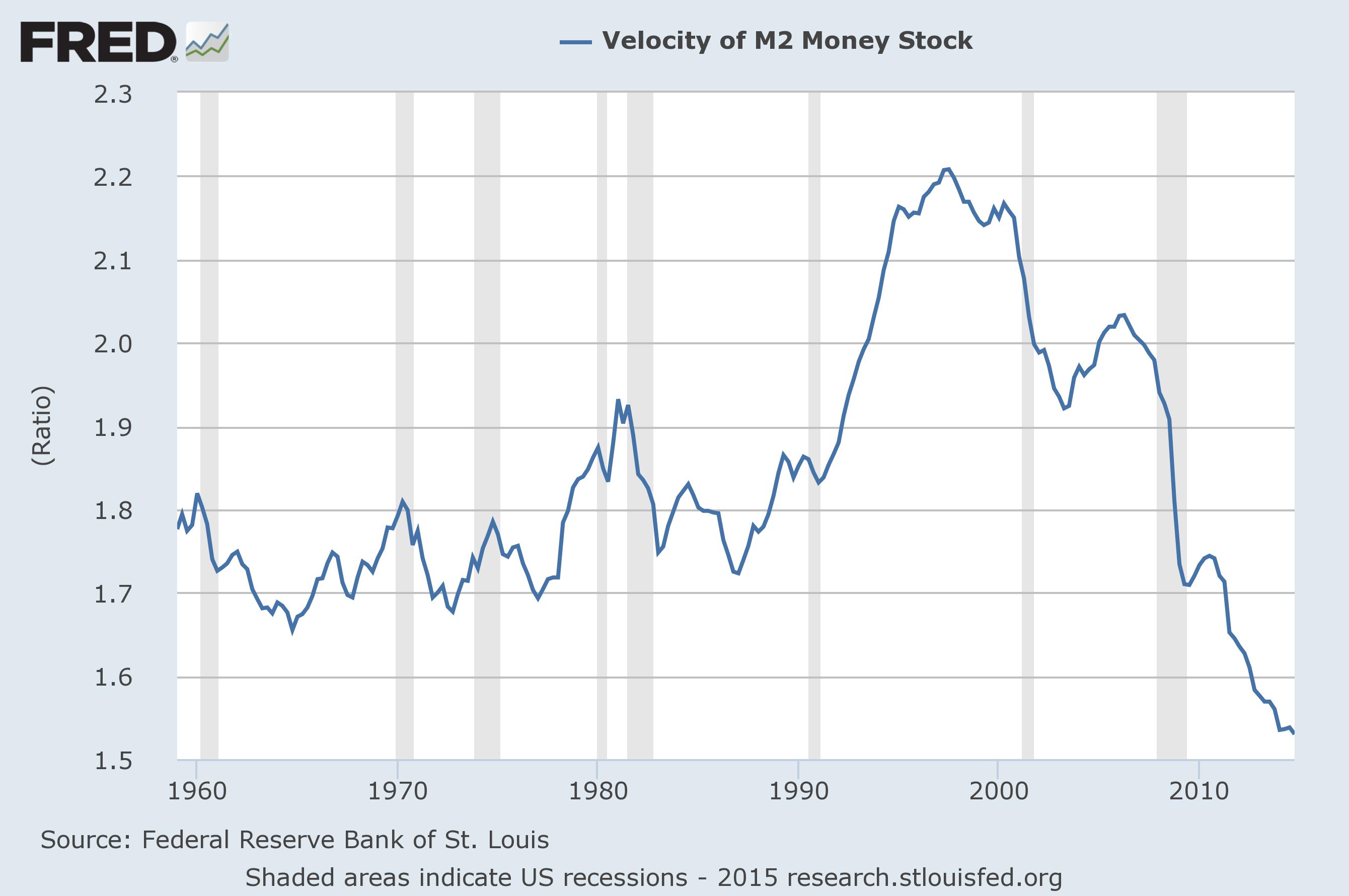

Currently the money has been very slow in making it's way to the herd, this is called the velocity of money. As you can see by the graph below it is almost stalled, ergo we have not seen much inflation, YET, despite 4 trillion dollars of spending by the Fed.

View higher quality, full size image (2680 X 1780)

3/26/15 #26: Messy, messy topic. Gender. Roll up ...

"Inflation is caused by an increase in the money supply."

This is where I get stuck. How does the money supply increase? How does it get decided how much money gets made?

3/26/15 #27: Messy, messy topic. Gender. Roll up ...

"This is where I get stuck. How does the money supply increase? How does it get decided how much money gets made?"

In reality the money supply does not need to change at all. This is another meme. The truth is before the Federal Reserve Bank was created the US dollar became more valuable from 1776 until 1913. IOW you could bury a dollar in 1776 and dig it up in 1912 and that dollar would be worth IIRC about $1.11. This is because there was no central bank to inflate the dollar. If you buried a dollar in 1913 and dug it up today that dollar would buy you $.04, that's right 4 cents worth of stuff.

The Fed has 2 levers, one is the money supply and the other is the interest rate. They have several ways to do this but it is not important to know the technical aspects of how they increase the money supply. Just that they do, e.g. the aforementioned 4 trillion dollar spent over the past 6yr.

This increase in money supply dilutes the value of the Dollar. That Dollar represents value. E.G. groceries have a certain value. If a basket of groceries is valued at $100.00 with the current money supply, it will be worth more dollars as the money supply increases.

Does this make sense?

3/26/15 #28: Messy, messy topic. Gender. Roll up ...

When do you guys build cabinets?

3/26/15 #29: Messy, messy topic. Gender. Roll up ...

Gees Mr.K I might ask you the same question.

3/26/15 #30: Messy, messy topic. Gender. Roll up ...

I don't build cabinets, I own the shop, but I'm behind on my bids because of this stuff!

3/26/15 #31: Messy, messy topic. Gender. Roll up ...

Ok, I will accept the blame.

Sometimes it is good to lift your head from the rice paddy to see what is going on.

Although admittedly I do this too much.

3/26/15 #32: Messy, messy topic. Gender. Roll up ...

Follow the $, you will often find it benefiting a politician. Actually most of what is done by the Fed Reserve is controlled by politicians in one way or another. I've got to admit I don't understand why "printing" $ hasn't made for a big jump in inflation. Why has the velocity been ever slower? Pretty sure there will be a big catch up in inflation, just don't know when. Too much $ will be chasing the same amount of available goods. In a sense money is also created by the need to pay for the trade imbalance. Congress does that by issuing bonds, transferring the payment to the future. It will therefore be someone else's problem.

3/26/15 #33: Messy, messy topic. Gender. Roll up ...

"I've got to admit I don't understand why "printing" $ hasn't made for a big jump in inflation. Why has the velocity been ever slower?"

Because the money is better used for speculation than investment. I.E. the stock market, stock buy backs, real estate, or just collect interest on excess reserve funds. All are much safer than making loans to business, which in this environment is anything but safe.

As Economics 101 says all jobs are created by investment in small business. The reason we are in the doldrums is that that investment is not occurring. Think back to the mid to late 90s when this forum was a buzz with the new cnc equipment. IOW we all invested heavily and jobs were created.

"Pretty sure there will be a big catch up in inflation, just don't know when. Too much $ will be chasing the same amount of available goods."

Tru Dat

"In a sense money is also created by the need to pay for the trade imbalance."

This is more due to the reserve currency status that the US exploits. Which may end in the not to distant future if the BRICS gain traction. It also means that China and Japan buy American stuff with those dollars i.e. real estate.

"Congress does that by issuing bonds, transferring the payment to the future. It will therefore be someone else's problem."

The debt will paid for by inflation. The thing that will hammer the US economy is entitlements.

3/26/15 #34: Messy, messy topic. Gender. Roll up ...

I was thinking about the value of $ and relative inflation in the US compared to other places I've lived or traveled to. When I lived in London it took $2.68 US dollars to buy one Pound Stirling. Today the rate is $1.49.

On the other side, when I was in Japan one dollar would get me 320 yen. Today it will get 119. Both of these examples show what the relative value is believed to be in trade. If you compare the pound to the yen you get a huge change, 343%.

Japan has been struggling with a stagnated economy for quite a few years.

The exchange rate for the US$ VS a lot of other currencies has also gone up. I suspect that will also slow or stagnate the US economy, at least to some extent.

3/26/15 #35: Messy, messy topic. Gender. Roll up ...

Yes that is true, but there are a lot of moving parts involved in that subject. Not the least of which is mercantilism. The current strength of the dollar is mostly about it being the slowest horse in the race to the glue factory.

But it will get weaker especially if the BRICS get traction. I'm thinking that it may be an investment opportunity along these lines.

3/26/15 #36: Messy, messy topic. Gender. Roll up ...

the future strength of the dollar

3/26/15 #37: Messy, messy topic. Gender. Roll up ...

"They have several ways to do this but it is not important to know the technical aspects of how they increase the money supply..."

Actually, that is the very thing I am curious about. But I don't even know how what the key words for the search engine would be.

See I'm sometimes a little low-level, but I figure everything has some sort of procedure. As in, this is somebody's job, and how do they do it? What are the rules? What happens between the money printer not being used and the money printer being used?

Don't know where I'm going with this but it's something I wonder about for maybe no good reason whatsoever.

3/26/15 #38: Messy, messy topic. Gender. Roll up ...

Mr Messy Topic--I kept busy, promise :)

View higher quality, full size image (3264 X 2448)

3/26/15 #39: Messy, messy topic. Gender. Roll up ...

Suit yourself:

How the Fed works

3/27/15 #40: Messy, messy topic. Gender. Roll up ...

Huh! Funny, i always thougt it was a simple question, but ever failed to get a good answer (this includes an evening with two economics doctorats).

Still chewing....

3/27/15 #41: Messy, messy topic. Gender. Roll up ...

The mechanism by which the money supply is increased: Federal reserve makes new dollars from thin air (one of their super powers) buys bonds from banks (increasing the banks' cash position). Banks are then supposed to lend it out to businesses, injecting more cash into the economy. That last step isn't happening right now, for a complex mix of reasons, including: 1) The Fed is paying interest to banks on cash, so why bother to lend it; 2) Dodd-Frank made the process of lending much more complex and burdensome, so it's hardly worth it for banks to make sub-million dollar loans; 3) Business owners who made it through the last crash are leery of debt, and prefer to self-finance operations (that's me!). So even though the Fed has created trillions in the last seven years, most of it hasn't landed on Main Street. This explains why inflation has been so low, and wages have been stagnant.

3/27/15 #42: Messy, messy topic. Gender. Roll up ...

As long as we are going to go full magilla on this, Mel should look up fractional reserve banking which has a big impact on this subject.

Currently the lending isn't happening with homes because of the cost of the housing, as the cost of housing has gone up so much. Not because of a lack of ability or willingness to lend. Although lending is certainly happening with multi tenant buildings.

I don't know about business, what Paul says sounds about right.

I think the main reason is that lending is not occurring is the same reason investors don't vet small caps, it is risky and a lot of work. Unfortunately this is what creates the economy. In the spirit of the full magilla look up Says law.

This is what happens when the Fed tries to control something that it cannot/should not control.

3/27/15 #43: Messy, messy topic. Gender. Roll up ...

Pat (Revere),

I have two questions that may or not be related:

1) Do you think the money supply should be regulated? If so, by what mechanism?

2) How does this work out globally? What happens if everybody decides to use China as the world bank?

Subset to question 2: According to my limited understanding, China seems to have a relatively healthy balance sheet yet somehow does this with a highly regulated economy. How does this compute with question 1?

3/27/15 #44: Messy, messy topic. Gender. Roll up ...

Paul, So true, so once again it comes back to the politicians.

I also only internally finance. I survived the last crash only because I had no debt. Certainly not because I was smarter than the average bear. Over my years @ this I've seen companies soar in size in very short periods. It was probably written in their business plan. Then be sold at auction. Then get grants, tax breaks, freebies, from some government agency to start up again in some other location, because they promised to provide X jobs.

Most likely the politician knows it is just as unlikely this time as the last. But he gets to stand in front of the media and claim to have created hundreds of high paying jobs. Seen it here for telemarketers, of course the pay big wages :>) want to buy a bridge?

3/27/15 #45: Messy, messy topic. Gender. Roll up ...

"1) Do you think the money supply should be regulated? If so, by what mechanism?"

The market regulates interest rates organically. If there is an surplus of savings the interest rates go down as per supply and demand. Conversely they go up if there is dearth of savings. This is how it worked before the Fed.

"2) How does this work out globally? What happens if everybody decides to use China as the world bank? "

The US would no longer be able to borrow just on there reserve currency status and congress could no longer spend on borrowed money.

"China seems to have a relatively healthy balance sheet yet somehow does this with a highly regulated economy. How does this compute with question 1?"

The short answer is that their secretary of the treasury is Wi Li

Hint when your GDP includes empty cities something something is wrong?

3/28/15 #46: Messy, messy topic. Gender. Roll up ...

Pat, may I pick at your brain a bit?

So everytime I hear about the federal reserve, people make it look like a bunch of clowns are partying around a money printing machine. Sounds pretty scary off the bat--independant organization printing money. Which is why I always wondered how this would be "policed."

As usual, totally off the mark.

First-- turns out, they actaully don't print the money, the u.s. treasury does. They distribute it.

Second--in terms of the general worry about policing... this reminds me of the Ukrainian karbovantsi. The "coupons" they used as currency.

When USSR fell apart, and Ukraine was left pretty broken, there was a point where there was nothing to eat, nothing being made--pretty grim. We know around here about the type of poverty where you don;t have money to buy what you need. But there it was a question of nothing even being on the shelves to buy.

So they just kept printing karbovantsi. And they were also easily forgable, so that too. So they reached an inflation point of over 10,000% at some point in the 90s.

I get why they did it--devestated country, and that probably felt better then just sitting there. But printing too much money is completely futile, it seems.

So this is the brain picking part--is money printing in a way self-policed by the results it generates?

3/28/15 #47: Messy, messy topic. Gender. Roll up ...

"1) Do you think the money supply should be regulated? If so, by what mechanism?"

Whoops I answered that too quickly this morning. I don't really know how that works except for the arbitrary policy that we have now.

But in my understanding it is not important as the reality is that is does not have to be changed at all, the only consequence would be that money would become more valuable. As it did from 1776 until 1913.

BTW money organically becomes more valuable as a result of technology. IOW as technology makes things cheaper money becomes more valuable (it can buy more stuff). E.G. the ubiquitous computer memory, but another one is aluminum which in the early 1800s was more valuable than gold or platinum. But technology made it possible to produce aluminum at a fraction of the cost in the late 1800s.

3/28/15 #48: Messy, messy topic. Gender. Roll up ...

"is money printing in a way self-policed by the results it generates?"

I guess so, at that point I would think that people would have to go to barter?

Hyper inflation is almost always a result of war. I.E. Wiemar, Zimbabwe, Hungary.

This is another problem with the Central Banks (of which the Fed is one) they facilitate war.

When the central banks crank the printing press they are trying to solve a problem. The problem is to pay bills. E.G. when the US gets into the 2030s or sooner the entitlements and the accumulated debt are going to cost more than the revenue the government brings in through taxes. At that point they have a choice crank up the taxes or inflate. Politicians being politicians will inflate and increase taxes and probably throw in a war as a diversion.

BTW this is not my opinion, it is just math.

Is this self policing? I guess so.

But the reality is that currently around 22% of the GDP is government spending in the 2030s it is estimated to be around 26%, the historic norms are around 18%. The point is that there is no way the US can pay back it's bills so it will have no choice but to inflate, increase taxes, and create a war.

FWIW your then finance secretary Paul Martin went on national TV as an educational program taught Canadians the abc s of budgeting and as a result got Canada's financial house in order, whose legacy has left Canada in better shape than almost all of the western countries.

This is something the Americans desperately need.

3/28/15 #49: Messy, messy topic. Gender. Roll up ...

Mr. Revere,

I have another (more) question(s):

During the financial apocalypse the banks were rescued by the Federal government. What would the net impact have been if, instead of guaranteeing their debt wholesale, if the government had instead just paid off everybody's delinquent mortgage? The bill would have been settled and the economy would have been reset with a bunch of consumers with less debt?

Question 2 has to do with government regulation. We all seem to be comfortable with the Federal government stipulating that all work past 40 hours in a one be paid at a rate 1.5 times regular pay. We are not allowed to even negotiate this away.

Why can't (or shouldn't) the government stipulate that all banking fines for illegal behavior be paid out of deferred compensation rather than just treated as a cost of business to be born by shareholders?

If it is okay for the feds to regulate cabinetmaker wages why is it not okay to regulate banker's wages?

If this is the law of the land why does anybody think these 'geniuses' are going to jump ship, and where would they go? Somalia?

What exactly do banks do? Isn't money just a mechanism just like any other public utility? If we can regulate the flow of electricity why can't we regulate the flow of dollars? How exactly does this "invisible hand of capitalism" do a better job for us than a regulated economy? For example, would we have more or less acidification of the ocean with a regulated economy than with a "free" economy?

3/28/15 #50: Messy, messy topic. Gender. Roll up ...

Dear Curious (Tim Shultz)

"What would the net impact have been if, instead of guaranteeing their debt wholesale, if the government had instead just paid off everybody's delinquent mortgage? The bill would have been settled and the economy would have been reset with a bunch of consumers with less debt? "

Don't know but I would guess considerably less.

"Why can't (or shouldn't) the government stipulate that all banking fines for illegal behavior be paid out of deferred compensation rather than just treated as a cost of business to be born by shareholders? "

Suits me. The reality is that the benchmark on this subject is, what is the true benchmark? What is the true value of something? And it is nothing more than one person selling something and one person saying I will pay this amount. As is the case with a car or a house. It is just that things get skewed when cheap money is made available as in the case of: education, housing, derivatives, healthcare, war equipment, stocks.

"If this is the law of the land why does anybody think these 'geniuses' are going to jump ship, and where would they go? Somalia?"

Just less goverment interference. The reality is that we have an 18 trillion dollar annual economy, that is a juggernaut that has to be admired. Nothing in history comes close. So don't throw out the baby with the bath water. But the exact thing that created the juggernaut is called comparative advantage. The trouble is that there is no comparative advantage with the state creates a monopoly or meddles with the market place.

"What exactly do banks do?"

The banks facilitate the economy by making loans. Banks aren't necessarily the bad guys. I'm glad I have a line of credit with one and that I got machinery financed by one. What is bad about that?

"f we can regulate the flow of electricity why can't we regulate the flow of dollars?"

Because it is simply too much information to regulate. Remember the USSR tried and it did not work out to well, to the point of Khrushchev inspecting in awe a normal US super market. Think about it, the average person makes what 10 transactions a day? Multiply that by 300+ million and you have what 30 billion transactions per day. Who can do that?

The only way it can work is for it to be a self regulating system. So each individual following his own self interest determines what is the best value for his needs.

This is quite interesting because not one single person knows how to make a pencil or a computer mouse, that's right not one single person in the world. As they would have to know how to mine graphite, fall timber, make paint, gather latex rubber, the coffee that keep the ship captain awake transporting the goods, the radio manufacturer, etc,etc, etc, etc. probably millions of people. This is all because of comparative advantage. Which is both a livelihood and a way of regulating this gargantuan system. The other is more of a charade that forces one to consider the red pill or the blue pill? But yes the invisible hand is infinitely better than the regulations. Not to say that you do not have to have some regulations but seeing how 50% of the population is dependent on the government in some way, the question is how much regulation?

"For example, would we have more or less acidification of the ocean with a regulated economy than with a "free" economy?"

This something called the tragedy of the commons. It occurs when something is not owned, as with the ocean. When something is not owned it has a tendency to be abused by people for obvious reasons. The best solution is to simply have the commons owned. That would be tricky in the case of the oceans or the air. As it is the oceans are over fished and used as a dump as it is no one's loss to do so. China doesn't care about polluting as it does not hurt China to pollute the air. I don't know what the solution if for this. But regulation will likely result in something very unworkable, OTOH no one can own the ocean or the air.

3/29/15 #51: Messy, messy topic. Gender. Roll up ...

""is money printing in a way self-policed by the results it generates?"

I guess so, at that point I would think that people would have to go to barter?

Hyper inflation is almost always a result of war."

Happy you mention this. This is initially what got me on this brain bend. The people that I know from war torn countries are never concerned about things like inflation. They buy where it makes sense. Used, refurbrished, new, black market-- if it happens to make sense. They buy what they can fix broken, or jump on opportunity purchases, and once in a while even buy new with warranty if the math adds up.

It doesn't matter to them what the economy is doing, they get what they need as they can, no matter how well their country is doing.

I sometimes wonder if well-off countries have trapped their citizens in a bubble of societally determined wealth. But then, who could argue about this, when it's just oh-so-nice to live here? There's a reason everyone wants to immigrate here.

Tip of the ice berg. I think about Eastern Europe a lot lately. It's easy to say Poutine is a big bad demon and write it off for economic pulls. But I think there is something more there.

I won't get too specific, but I have an american friend who had a position for u.s. military the involved him making the decision on who dies in sandy countries. This poor boy came back to mental mayhem and a whole lot of medication to regulate what he has seen.

But he had gotten used to solving problems with death. Now I'm a big ol' softy, and I sure do love my fellow man, and even the more beastly types amongst us, but I'm also a die hard pragmatist, and get how he got there. I've heard this poor man lament the death counts on his back but also visualise solving social problems with mysterious disappearances. I get this. It's not pretty, but it's there.

Now if you extrapolate this to the people that run the places like Russia--they are all people that come from military/intelligence backgrounds. Solving problems with inhilation has been somewhat hardcoded.

Which is why, I have to admit, that sometimes the world scares me a little bit.

Hope this isn't too much of a mental spill :)

3/29/15 #52: Messy, messy topic. Gender. Roll up ...

"I sometimes wonder if well-off countries have trapped their citizens in a bubble of societally determined wealth "

There is very little to wonder about. The niceties boil down to allowing comparative advantage to do what it does. The Orwellian aspects are from allowing a government (any government) to do what it does. This county will continue on for a long time but to be sure there are some hard times ahead because of this.

But are the wars really necessary?, are the bubbles really necessary? is the co opting of the citizens, with 50% drawing some sort of government transfer, really necessary? is cronyism in big pharma or healthcare really necessary?

3/29/15 #53: Messy, messy topic. Gender. Roll up ...

For some reason I fear complimenting you, but I'm going to do it anyways. One beautiful mind you got there. Hope you know that.

Comparative advantage-- I find it a tricky concept. I like that someone coined it, but I hate the idea that you can compute it. Not sure how it really goes.

This once again comes back to Godel. I hated his incompletness theorum when I first heard it-- as it seems annoying in broadness. But the more I explore things like comparative advantage, the more I think about it.

I like the idea of follow the money as it is a good barometer of reality, but then again it forgets things. Massive things like hey you, how is your day-to-day? Are you comfortable and cushy but bored to heck? Are you getting dangerous at the top of maslow's pyramid?

People chase dollars for what they think it will get them. When poop hits the fan and there is no status tickets to even be gained in the country, they are left with what they have and what they make of it.

That's when you see what people are really made of. There's some beauty there--though no one wishes it on anyone else.

3/29/15 #54: Messy, messy topic. Gender. Roll up ...

This video explains it very nicely.

Comparative advantage

3/29/15 #55: Messy, messy topic. Gender. Roll up ...

My, my, there certainly is a bit of Fed nonsense on this thread.

First, the Fed is a GOVERNMENT operation. Allow me to bore you with a few facts I posted 2 or 3 years ago --

---- start dry recitation of important Fed facts ----

The Federal Reserve System Board of Governors is a FEDERAL AGENCY created by federal law. All 7 members of the Board are nominated by the President and confirmed by the Senate for 14 year terms. The System BoG formulates monetary policy. The System BoG is where reserve requirements are set, where the discount rate is set, and where rules and regulations are adopted.

The 7 System BoG members are a PERMANENT MAJORITY of the 12 member Federal Open Market Committee, the other 5 members being the President of the NY Fed and 4 other regional Fed bank presidents each serving one year terms.

Regional Fed bank presidents are appointed (subject to approval by the System BoG) by each regional Fed bank's 9 member Board of Directors, 3 of whom are appointed by the System BoG (none of these 3 may be an officer, director, employee or shareholder of any bank,) and 6 of whom are elected by the member bank "shareholders" (3 of these 6 may not be an officer, director or employee of any bank.) One of the directors appointed by the System BoG is designated by the System BoG as Chairman of the Board and another as Deputy Chairman.

The 3 "bank" representatives on each 9 member regional Board are excluded from the process of appointing the regional Fed bank's president.

The Chairman of the System BoG is also the Chairman of the FOMC. The FOMC implements System BoG monetary policy. The FOMC is where fed funds target rates are set, where margin rates are set, and is responsible for open market operations to carry out policy.

The System BoG and the FOMC are where ALL of the actual power of the Fed resides. The 7 System BoG members nominated by the President are an absolute and permanent majority of both the BoG and the FOMC. They hold and exercise ALL of the power of the Fed.

---- end quick summary ----

Any and all ridiculous conspiracy theories about the Fed being somehow "private" notwithstanding. It ain't. Never has been.

And don't bother with regional Fed bank "shares," they're nothing more than the deposit needed to become a Fed bank member. If you owned any such "share" as a private individual, you would be horrified.

The Fed was designed to allow some private input (a good thing,) but that's it.

Would we be better off without the Fed? Without a doubt, but that ain't what we've got.

Second, there is no mystery about where the 4 trillion expansion of the Fed's balance sheet went. It financed the federal government's deficit. Period, end of story.

When the guys on the FOMC's trading desk buy $X billion of mortgage debt or US Treasury debt (creating money by crediting the sellers' accounts) what happens?

99.9+% of those sellers are institutions -- mutual funds, pension funds, hedge funds, banks, etc., etc. -- who just sold some bonds to the Fed. They now have cash to put to work. What are they gonna do? Buy other bonds. It's their (private-sector) job.

Not stocks. Not real estate. Bonds.

They might buy other mortgage bonds, they might buy corporate bonds, but mostly the money migrates to US Treasury bonds. Maybe not from the first seller, but from some subsequent seller.

Proof? The change in privately held US debt from 10-1-08 to 10-1-14 was 7 trillion -- from 5.8 trillion to 12.8 trillion. (Never mind the higher numbers frequently thrown around, those include 5 trillion of useless "trust fund" bookkeeping entries.)

So, independent of Fed "help," we (the US government, such as it is) actually managed to peddle 3+ trillion of debt to the public and world at large. The Fed bought the other 4 trillion or so, give or take.

Can we get away with this forever? No.

Has the Fed holding interest rates down created asset shifts among private investors? Without a doubt. But, these happen all the time and will continue.

Could the US have borrowed the whole 7 trillion without jacking interest rates up significantly, absent the Fed? Not likely.

Will the 12.8 trillion be slowly inflated away? Absolutely. We've already gotten rid of maybe one trillion of original value at the time of issuance with the ~2%/year inflation of the last 6 years. More to come.

Every year of 2% inflation destroys 250 billion of value. If inflation going forward is 3%, it only takes 3 years to destroy a trillion of current bondholder value. 20 years of that and 13 trillion is only worth about 5 trillion in today's dollars.

But, with an average maturity on the whole 12.8 trillion pile of about 5 years, there's a reasonably long fuse on it.

Moral of the story? Now is probably not the time to buy bonds. Any kind of bonds. If (not when) yields rise, the market value of the principal falls. (Quick, very round number example -- 3% current yield bond ---> 6%, current principal value of 100 ---> 50.) Ugh.

10 to 30 years is a long time to wait for principal to be paid off at par. Kind of like waiting for a delinquent customer to pay for his wife's beautiful new kitchen out of his estate.

3/29/15 #56: Messy, messy topic. Gender. Roll up ...

So you are saying the 18 trillion in debt is really 13 trillion? What is the other "trust fund" about?

Where you say "if" the interest rates/yields rise. Seems to me that will be when inflations gets too hot?

The SHTF when the entitlements come into full bloom that and interest on the debt goes above zero or near zero.

The 4 trillion does not hit the economy equally so those close to the spigot have put that money into stock,RE, and buybacks. Are you saying that is not the cause of the stock market and RE going up so much with an anemic economy?

3/30/15 #57: Messy, messy topic. Gender. Roll up ...

Pat--great video.

I'm reminded of an essay we had to write in a history of psych class. We were to look at ideas that were happening, in terms of human thinking trends, when darwinism popped up. Then figure out what they had in common to see how the idea popped up.

The conclusion the students were supposed to get is that history wrongfully portrays big ideas to a single person, like they had a massive single hand epiphany out of the blue. Rock star style figure head.

Econ--I took a closer look at The Fed in terms of staff. All I saw were a group of very academic economists. It's actually way less scary then it's been portrayed to me by most (not here on the forum) --owners of vaste fortunes manipulating economy for their own benefit.

But you mention doing things another way--any ideas? What would you change? Any other countries system you like?

Side thought, but I have been looking at past cases where countries at war have used good quality mass counterfeits bills as a weapon, to instill hyperinflation in the country they are at war against. Wowza!

http://http://militaryhistorynow.com/2014/08/08/funny-money-the-amazing-history-of-wartime-counterfeiting-2/

3/30/15 #58: Messy, messy topic. Gender. Roll up ...

Hi, Pat, yeah, all sorts of people are really sloppy about the total NET public debt.

It's 12.8 trillion. The other 5 trillion is the bogus set of "trust funds" (99% SS and Medicare) which just contain special US debt. Can't get a dime out of them without selling regular new US debt to the public (or the Fed) to redeem the special US bonds held by the trusts.

Meanwhile, the bogus "trust funds" are both an asset of the US SS and Medicare systems and a liability owed by the US to SS and Medicare. Net? Zero. A 5 trillion wash.

Every single business day excess FICA tax revenue comes in to those "trust funds" and is IMMEDIATELY sent (by law) to the Treasury's general fund in return for a special T-bond (by law.) Routine daily Treasury book-entry transaction.

The 5 trillion is just the running total of excess FICA revenues which have already been collected and spent on other stuff.

Excess FICA tax amounts are the same as any other dollar collected. The "trust funds" get a special IOU from the US government. They contain zero cash.

That 5 trillion is really just the tip of the 100+ million of unfunded SS and Medicare liability. It's the only part of the unfunded SS/Medicare liability that actually appears on the US balance sheet.

As for interest rates, they obviously have to rise at some point. The Fed will likely be very, very careful, they don't want to dig another hole to fall into.

Some sort of entitlement reform has to happen or the 5 trillion of "trust fund" debt will shortly (over say 10-15 years) become ACTUAL public debt (that would be the 18 trillion total) and to that we can add another half-trillion/year or so, increasing to a trillion+/year, forever.

Barring extraordinary growth, that's probably not sustainable. Never mind that high debt levels are themselves a constraint on growth. And never mind that moderate inflation will destroy 250 or 400 or 600 billion of existing debt value per year. We'd by losing net debt-ground every year.

Not good.

As for the 4 trillion, it financed government debt. Proximity to the "spigot" doesn't matter. The Fed bought debt issues from the open market -- that served to keep long rates a little lower than they otherwise would have been.

Stocks discount future earnings, which have been fairly robust over the last 5-6 years, despite crummy 2%-plus-or-minus GDP growth.

RE is a function of interest rates and cyclic. Measured over decades, RE only keeps up with inflation, if that.

So, yes, the Fed is not the cause other than to the extent that they have held long rates down a bit.

Contrary to the received public wisdom about "bubbles," etc. which is generally useless and usually completely wrong. Not to mention destructive of capital, if acted upon.

3/30/15 #59: Messy, messy topic. Gender. Roll up ...

Mel - The Fed employs a great many people who produce no end of economic papers and suchnot.

The primary purpose of the regional Fed banks is to do economic scut-work. And so they do.

It's a good thing that they mostly keep themselves harmlessly occupied, beavering away at no end of obscure economic topics.

As for doing things differently, you in the Great White North had a great idea that you have steadfastly maintained when it comes to bank lending. Namely, that the lending bank retains all or most of the loan.

What a thought, eh? Force a lender to have some serious skin in the game. Pure genius, or, as some would say, common sense. Too sophisticated for mere US lawmakers, the sorry dopes. Over many decades, dating from the 1930s.

We got Fannie and Freddie and hundreds of billions of losses due to ridiculously low loan standards that nobody in their right mind would allow (NINJA, anyone? no income, no job, no assets, oh, and by the way, here's a grant for the down payment,) but were forced on our banks over a couple of decades by our all-knowing government. And Fannie and Freddie securitized almost all of it and sold it to the world.

What could possibly go wrong?

As for the Fed, it exists because people didn't like "panics." 1873 and 1893, for instance.

So, instead of a quick 20% or 30% dump in GDP, and an equally fast recovery, you get a 5% or 10% drop and the recovery may suck.

Great. The problem is that a lot of businesses that should have been wiped out, weren't. So, there is a lot less capital and fewer people freed up to do other, more productive things.

A central lender of last resort can be a good thing, but, how shall I put it, the interference of that lender of last resort probably has a net negative effect, all things considered.

As for counterfeits, it's really meaningless in an electronic banking system. When it comes to minor players, we already fixed the Norks' wagon on that front.

3/30/15 #60: Messy, messy topic. Gender. Roll up ...

Hey Econ 101

As usual I go to school on your posts. A couple of things I have a hard time reconciling.

The growth is not going to be there for 2 reasons that I see. One is the demographics of the US, i.e. the boomers are all going to 65 or older by 2030. Two is that 25% or so of the GDP is government spending which is not going to be there if interest rates rise and or the entitlements fetter the spending.

The hard reality is that our current politicians (both sides of the aisle) are too selfish to talk about entitlements.And the constituents are too selfish to listen.

Without a whispering campaign or similiar to wake up the herd, it ain't gunna be good.

You say that the Fed does not cause bubbles? To my thinking it started with Greenspan who printed money so that the economy would stay up after the dot com bust, followed by Bernanke doing the same after the housing bubble burst. Not to mention the unintended/intended consequences of the Bernanke put. To me the housing bubble was a direct result of the Fed.

When they printed 4 trillion to buy mortgages and treasury bonds that money did two things that I see. It kept business afloat that should have gone under which diverts funds away from investment and kept afloat AIG, Goldman, etc. The other is an increase in the money supply. I don't how much of that went to Fanny and Freddie, but the rest certainly would have increased the money supply.

So how come no inflation? Because the money did not make it down to main st instead it went to RE, Stocks, and Buy Backs.

Also a big part of the money supply is credit, which is what about 60 trillion and that did take a dip in 2008. The M2 part of the money supply is what about 12 trillion.

But still the conventional wisdom is that those who benefit from inflation is because of their proximity to the spigot, what am I missing?

3/30/15 #61: Messy, messy topic. Gender. Roll up ...

Another aspect of what the Canadians do right is that their banks are not controlled by politics.

Since 1840 the US has had 17 banking crises and the Canadians have had none. The reason for this is that banking in Canada is not controlled by an agency controlled by politics. They use an autonomous agency that makes decisions based on common sense.

The US on the other hand has the Fed that has a committee that has to determine if a bank "is a good citizen", before they can merge or expand, which is very subject to politics.

The point is that this is how banks were centralized in the 80s. And a whole bunch of money was thrown at citizen groups to get their endorsement, showing that the bank was "financially responsible". BTW the amount of money involved was around 2.5 trillion dollars.

Why Canadian Banking is more stable

3/30/15 #62: Messy, messy topic. Gender. Roll up ...

"The conclusion the students were supposed to get is that history wrongfully portrays big ideas to a single person, like they had a massive single hand epiphany out of the blue. Rock star style figure head."

Sactly, that is a very interesting point. Reality is agreement, perception is reality.

I love that video. It points to the very reason we are not still hunter gatherers.

3/30/15 #63: Messy, messy topic. Gender. Roll up ...

To the both of you, or anyone else into this sort of stuff.

So I have a bit of confusion regarding untangling conspiracy from nasty ol human behavior.

There is without a doubt a lot of scary behavior in humans--be it straight raw animal aggression, or all the way to organizational psychopathy.

Nasty things have been going down, all over history--an example on my mind is when USSR got rid of all their handicapped war vets to send them to a "sanitarium"...where none of them would ever be seen again and the streets would have quasi-no handicapped person to be seen, for decades.

And of course Stalin starving the nations to feed Moscow; Hitler--well no use specifying, we all know that one.

There is no doubt that there is a fair amount of ruthless, nasty, sometimes organized, behavior in this world.

But then there is propaganda. And then there is down right dichotomous thinking and fear, in general uninformed population, blowing things out of proportion.

How do you go abouts to untangling this confusing madness?

3/30/15 #64: Messy, messy topic. Gender. Roll up ...

beer

3/30/15 #65: Messy, messy topic. Gender. Roll up ...

If you know how things work it helps to spot the BS, especially economics.

But overall I would say the use of logic. You cannot overstate the value of logic.

I have not studied it but I hear the same thing about game theory.

For starters you know you are not getting the straight dope from the major television stations or most newspapers.

E.G. by using elementary logic and basic economics it is very easy to see through the story from the NYT about income inequality.

Unfortunately most people are not wise to this and consequently drink the Kool Aid.

As to the heinous crimes, my first thought is what does the person telling the story stand to gain from the story. E.G. the reporter wants a scoop to build improve his image in his profession. Secondly someone stands to benefit from a war.

3/31/15 #66: Messy, messy topic. Gender. Roll up ...

Doesn't the same guy who owns Fox News also own the Wall Street Journal?

Do you think there is a correlation here?

View higher quality, full size image (697 X 289)

3/31/15 #67: Messy, messy topic. Gender. Roll up ...

I cling to that, but think it gets sometimes even messier than that. It comes down to perspective dictating reality, as you mentionned.

Perspective is strong. Ever heard of Elizabeth Loftus? She conducted a mass of research concerning eyewitness testimony. She started with a mass lecture setting, where an actor comes to "shoot" the professor down, and a bunch of actor "cops" come interrogate the students about what they saw.

The first series involved a very realistic fake gun with realistic sound effects. As she saw that people saw it as a real gun, she replaced it with a very fake toy gun, with the actor screaming "bang". Still reports of real gun/shooting.

She then, I kid you not, replaced it with a flag throwing toy prank gun--same thing.

So the last series ran had the actor use his hands in a gun shape, yelling bang, and still same thing.

All interrogations, in all settings, had students reporting a shooting. Setting was right.

But that still doesn't negate the fact that when something truely crazy happens, it takes you a while to even admit to yourself that it did happen.

Brains are fun, no?

3/31/15 #68: Messy, messy topic. Gender. Roll up ...

There is a market forecaster called the Elliot Wave that some respectable people swear works. It is based on the premise that reality is a reflection of the agreement people have about the economy.

3/31/15 #69: Messy, messy topic. Gender. Roll up ...

I am familiar with that one, and I sure do beleive it. It's good to live where we live, really. As with the karbovantsi--print it to make em feel better. You can't, really, but you have too.

Perspective--full circle back to gender, and probably the Pi movie argument.

After your strawman argument post, and me hitting my face with my palm, I went back to work and opened my eyes a bit.

Mind is everything there, especially because they are little 'effed, and very, very, strapped for mind. Only the worst of employees have that other sort of thing on their mind.

But at the end of the day, or even the minute, they don't matter. People that give me what I want (brain food and fun with saws) are people that just need someone to do what I do.

And if everyone's eyes sparkle when I one-man a maple-ply 4 x 8 sheet unto a panel saw, that's just a thing of beauty, really.

I hope I get to buy you a beer one day :)

3/31/15 #70: Messy, messy topic. Gender. Roll up ...

Pat,

You say "by using elementary logic and basic economics it is very easy to see through the story from the NYT about income inequality."

You then go on to say that this is because of people's tendency to "drink the koolaid".

A month ago I posted a thread from the New York Times Business section about how social media was changing how our customers purchasing decisions. At that time you admitting to not reading the NYTimes.

Are you doubling down on your cold medicine again or is this just a case of drinking to much koolaid?

3/31/15 #71: Messy, messy topic. Gender. Roll up ...

No change, someone posted the NYT article on the woodweb.

They may be fine on other subjects but are very biased regarding economics.

3/31/15 #72: Messy, messy topic. Gender. Roll up ...

Pat,

Can you name for us a single source of information about economics that is not biased?

Economists have two possible career paths.

46.7% graduate from college then go to work in the basement of some bank cranking out annual reports. These reports have a lot of charts. The charts always support some agenda.

59.42% go to work for the New York Times or Fox News (Wall Street Journal) or some other politically based group-think tank funded by the Koch brothers.

They trot out statistics that always corroborate the fundamentals of their argument then describe this as 'logic".

Logic has nothing to do with charts or statistics. Logic is logic.

Two things to remember: There has never been a chart made in all of history which did not have a predetermined result and 67.4% of all statistics are made up on the spot.

3/31/15 #73: Messy, messy topic. Gender. Roll up ...

Yes, I'm sure you are right.

3/31/15 #74: Messy, messy topic. Gender. Roll up ...

To NY Times Reader: Back, a very long time ago while I was in college, I drew maps and graphs for professors research papers. It was good $ for a college kid. All of them told me what they wanted to show, emphasizes, and I would manipulate the way the data was presented to do that. Same can be done with choosing the way maps are drawn.

Like Sam C. said, There are lies, damn lies and statistics. The news media are horrible for their bias, left & right.

3/31/15 #75: Messy, messy topic. Gender. Roll up ...

Larry,

Not much has changed since the days of Samuel Clemens except that the silos of information have become more and more parsed.

With 7,000+channels available 24/7 it is possible now to get your news updates from stations aimed squarely at Clarinet Playing-Transgender-Fly Fishing-Fiscal Conservative- Organic Gardening-Cabinetmakers. I find this particular station on the dial to be the most unbiased because it does not have a clearly identifiable agenda. You just can't be sure these days. You need to follow the money.

3/31/15 #76: Messy, messy topic. Gender. Roll up ...

I will give you that there is bias, how can there not be as an author writes from his own perspective.

But certainly gets way past disingenuous as well. I heard it said that 75% of the endorsements on book covers were never read by the endorser.

Then there is the tendency to deify people and things who may or may not have done some great things, but I will guarantee you they had some not so fine moments as well. Suffice it to say if I hear one more comment about how great Lincoln was I'm going to puke.

I think all of this stuff requires some practical judgement and that does not come overnight.

Above and beyond that I would say most of us and America are functionally illiterate. Certainly regarding economics, which is more apt than you would guess.

The more I look at this stuff the more I'm inclined to go directly to the source as there is less bias in FRED graphs, housing start graphs, PMI/ISM graphs, etc. Not to say that the unemployment graph is not skewed or the CPI graph is not skewed hell even the GDP graph is skewed. OTOH the velocity of money graph is not skewed or the bond prices are not skewed, not that the Fed doesn't have a huge affect on interest rates (econ 101 says not so much, which may be true)

Then there are other factors like secular trends because of demographics, or international trade or technology. But none of this stuff is understood in sound bytes.

Oh and if you think I'm being patronizing, yea maybe, but mostly I find this stuff interesting. I mean who didn't say WTF after 2008?

4/1/15 #77: Messy, messy topic. Gender. Roll up ...

oooo Larry--that.

"All of them told me what they wanted to show, emphasizes, and I would manipulate the way the data was presented to do that. Same can be done with choosing the way maps are drawn"

The craziest interview I ever had in my life was when I was a cognitive neuroscience student and wanted to be a research assistant part itme. The research focused on phoneme recognition, but needed MRI. The only MRI readily available for research purposes was in the Down's syndrome research lab.

So the Prof modified his research to fit Down's syndrome to get MRI access. The big obvious elephant in the room is that in Down's syndrome patients, they mostly can't read--or any capacity, not the ideal subject for phoneme recognition research.

I still remember sitting at that interview and wondering if I was the only sane person in the room :)

4/1/15 #78: Messy, messy topic. Gender. Roll up ...

"Logic has nothing to do with charts or statistics. Logic is logic "