Question

I need some help with my accounting. I use QuickBooks and when I refer to COGS and Expenses, I am using them in context of QuickBooks. But as far as accounting goes, I suppose it should not matter.

As I understand it, items purchased to make a cabinet are COGS because these are not really expenses until the item is sold. Meaning that the drawer slide I buy for a cabinet is not an expense in the same way as my electric bill is. I convert the cash into a material that is an asset (drawer slide) until I sell the cabinet, at which point the COGS are considered an expense against the income. But items like sandpaper and electricity are expenses and not COGS.

I believe that COGS are usually only used when there is inventory involved. I do not keep an inventory of cabinets, but I do keep an inventory of the parts used to make the cabinet.

So, how does this sound?

EXPENSES = sandpaper, tooling, sharpening, glue, dowels, WD40, earplugs and stretch wrap.

COGS = melamine panels, slides, hinges, laminates and closet rods.

Looking at the two lists above it seems that all the COGS are things that I can easily track and account for in a single job. Expenses seem to be things that are harder to peg to any one job. Do you guys assign any items as COGS or simply expense it all? Do you keep items in stock (hinges) but still expense them? If so, how do you allocate the expense of the hinges to a job after they are pulled out of the big pile of hinges?

Assuming you consider your materials on hand as COGS, for special items ordered for one job that are not really kept in inventory (laminates, veneers, special hardware), do you still consider them COGS?

Forum Responses

(Business and Management Forum)

From contributor C:

You are very close in your thinking, however, the money spent on COGS will never become an expense. I use an expense account called Fabrication Consumables for the items you mentioned like sandpaper and saw blades. It is very important for you to keep the COGS and expenses separate to determine your gross profit. Otherwise it is more difficult to determine the difference between sandpaper and a slide. I know that keeping an accurate inventory in a cabinet shop is a lot of work, so if you just order your materials under the account of COGS, it will accomplish the same on the income statement, just without detail. The inventory is adjusted by use of part numbers on the invoice. But I have never seen a cabinet shop that lists individual items on its invoices. What I think I would do is set up a Special Order - Cabinets item. When you are setting it up, it asks you if this is sold to a specific customer and you check yes. That way as soon as it is received, it will not try to go into inventory. Your books should show zero inventory.

Office supplies, tools, toilet paper, machinery repair costs - these are not used to create the product, so they are not COGS. Items like rags and sandpaper which are integral to the production of the goods, but do not become part of the goods, are a sub-category of COGS called consumables. So in your categories above, I would move sandpaper, glue, and dowels in to the COGS category. They all get used to produce the product.

You track COGS separately for two reasons. One, they are a straight deduction from your corporate income on taxes. And two, you need to know exactly how much you're paying for the parts and labor that go into the products you sell.

Your question about hinges is a good one. Theoretically, if you stock hinges, you need to track them as Inventory. You receive the hinges, you put them in inventory in the computer. You build a product, you pull them out of inventory in the computer and this gets posted as a job expense.

Managing and tracking inventory is complicated and a major pain for a small business. So I recommend not doing it. Order materials for each job individually and just post them as a COGS expense to each job.

If you have to order larger quantities, you may have to allocate a larger than normal expense to a job - say, the cost of 1000 hinges going to a job with only 100 hinges. This throws off your job costing on a per-job basis; but you can look at a number of jobs over a longer time period and you can average out the job costing that way.

I will not use QB to bill the customers. All pricing and invoicing is done using a custom relational database that calculates the pricing for all our work and creates invoices, estimates, and proposals. I use QB to make purchase orders based on the job material reports in Cabinet Vision. Job orders and all the documents the customer sees are made in the relational database. When I enter a job into QuickBooks I add all the materials that come from inventory, and the materials that were bought for the job. Then I enter the incomes on the invoice for labor, materials, installation and delivery. All of these numbers come from the relational database as well.

What this means is I am only using QB to track the profitability of jobs and my business. I never actually print any invoices out of it to give a client. This is all done in another program.

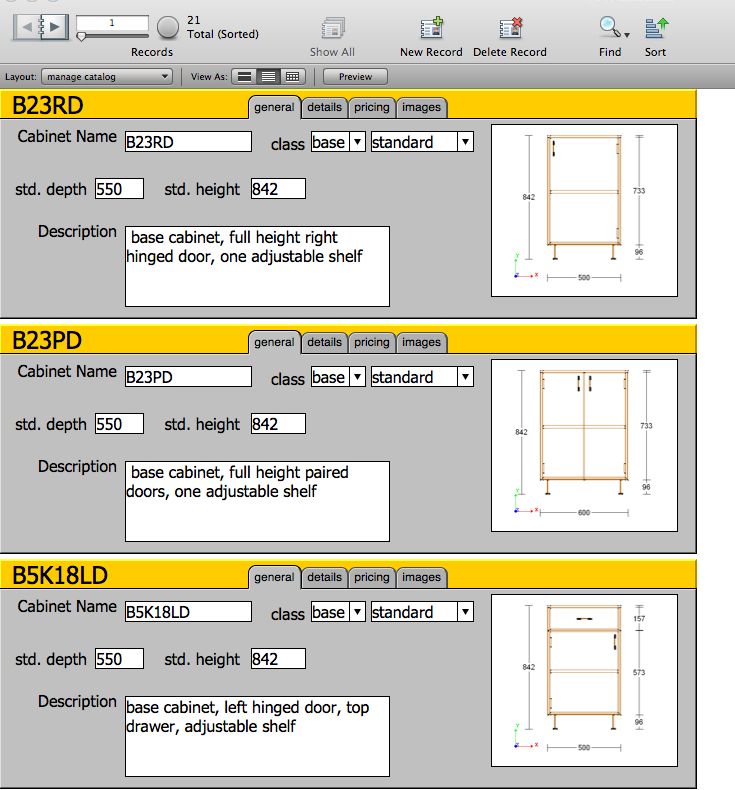

This must sound horribly complicated but it actually simplifies things for us. I have several designers and sales people that sell for me, and they all use different software and they generate tons of job leads. If I had to make a layout of every job lead in Cabinet Vision just to get the pricing, I would never leave the office. So instead I have a complete catalog that I developed in FileMaker Pro. There are hundreds of cabinets and the possibility to price completely custom assemblies. This catalog, complete with pricing, is given to my sales people, general contractor, other cabinet shops and developers. So they can bid the jobs themselves. Even if I am the one selling a job, it is faster and more accurate for me to use the database catalog to create proposals and invoices.

We usually do not even have to enter the jobs as a layout in CabinetVision. We can just batch the assemblies straight out of the catalog.

QuickBooks is used to track the profit and accounting for the business. I particularly want to be able to accurately track job profits. This is where the COGS comes into question. If I consider items like sandpaper and labor as COGS, it will require me to track how much labor and sandpaper I use on a job... I consider these things to be overhead items, or expenses. Specifically I do have accounts for "production consumables."

If I assign sandpaper as a COGS (technically I know it is), how will that effect my gross profits and other numbers in QB? Can I treat COGS like a non-inventory expense that is not assigned to a specific job? If so, how do I tell the difference between a job's gross profits and the company's net profits for the month/year?

As it is now, all COGS are assigned directly to a job. Expenses generally are not. As someone else mentioned, this inflates my gross margins. I would like to have Quickbooks allocate more of these expenses to jobs, but it is not practical to track the amount of sandpaper used in a job.

I suppose that if these consumables are treated as COGS, my gross numbers will be more accurate for the company, but it will not help the gross profits for a job.

Sorry this is all so rambling. I am trying to wrap my head around this as I go. My goal is to keep QB as simple as possible. I had it set up very complicated before and it was a nightmare. On the income side I only have a handful of items (labor, materials, installation, delivery). I never enter itemized income items. But I do itemize the expense side of everything. What do you think?

When you say "raw materials," what kind of account is that? COGS, expense, etc. I guess you mean you would expense it to a specific job? I can do that for some items like special melamine and veneers, but I order the case materials in bulk. And I do want to inventory them.

As far as deciding what you should track as COGS, I'd say two things. One, it depends on how fine you want to track job costs. So if you don't want to include sandpaper, that's fine. I don't track sandpaper on a per-job basis, and I don't post sandpaper expense to a specific job. But it shows up in COGS because that's what it is. If I want to get a better handle on per-job costs, I can do a report for a given time period, say a year, and look at how much I spent on sandpaper. Then do some calculations to figure out an average sandpaper cost per job. That's what works for me. Does it skew job costing a little bit? Yes, but not by much, so I don't care.

The second thing is, make sure whatever you're doing is in line with standard accounting principles. COGS has a specific definition in accounting (Google it to get a better one than I gave you above). So it's best to make sure that you're calling things COGS that actually are. That way, your accountant is deducting them from your taxes properly. If you have a completely independent system for job costing that your accountant never sees, then call things whatever you like. I can barely remember what to buy at the grocery store, so multiple categories for the same item might make my ears smoke.

- If you assign sandpaper to a COGS account, but do not post it as an expense to a particular job, this will make your jobs look more profitable if you look at them individually. But it will still show up in your P/L statement as COGS. So it will make gross profits per job look slightly better, but your gross profits on, say, a monthly or quarterly or annual basis will be accurate.

-Yes, you can treat COGS as a non-inventory expense. But you're right, if you do that with all COGS, then you can't look at job profitability with any significant degree of accuracy. All jobs will look equally profitable in a given time period. So I don't think you'd want to do that.

One of the reasons I am redoing my Chart of Accounts is that I have Expense and COGS all mixed up. I have not been able to use the automatic profit reports in QB because of my miss-assigned accounts. I think I understand the definition of COGS. Wikipedia and Wikiaccounting have great explanations.

My catalog database is very similar to what other companies are offering (True32, cabshop live, Cabinet Vision business package). In fact I think I am using the same development software (FileMaker Pro) that the other developers are using. I decided to do it myself because I have very specific pricing methods and I want more freedom on how I distribute the catalog. FileMaker allows me to host the catalog on a website, print it as a PDF, load a fully functional version onto my Iphone/Ipad and convert the database to several other formats for sharing. I am including a screen shot of what I have so far below.

By using this approach I am not as reliant on Cabinet Vision to manage everything. We now only use CV for engineering, layouts, production and materials ordering. As I said before, we often skip the layout because our sales people use other CAD programs or SketchUp to design the job. For bidding jobs and pricing the items in the catalog, there are very accurate formulas used to calculate the material usage and labor.

Another accounting question. I know that shop labor is "direct labor" and therefore COGS. Do you guys count shop labor as COGS? I do not actually track the number of shop hours on a job in any meaningful way. I just consider it to be overhead because I have to pay them whether we work or not. Plus there is the issue of when the shop guys are building shop fixtures or display cabinetry for the showroom.

Depending on where you are, there may be reasons to separate these things, especially if you are trying something new. We used to have a pretty liberal R&D program up here in Canada that lots of people took advantage of.

A) I have my guys (and even myself) fill out time sheets for each job - so this is a COG. I love reviewing my P&L statements per job. It's certainly not an exact system but it evens out over time.

B) All materials are ordered with a PO # on it so the bookkeeper will categorize it (even if it just goes to replace the item in stock).

C) I have estimated over time that general expenses (building rent and business development down to sandpaper, etc.) adds about 20% to the total. So in my mind I am looking for about a 40% gross profit at each project.

D) My downfall is a very messy looking QB.

I have been able to keep very good track of my business profitability but my PL statements are way off due to the fact I was not using COGS before. This is what I am trying to correct. Also I have to start using PO forms now. I have been sending typed out emails and texts for years to my suppliers, but it is really getting to be a mess so I am using QBs PO system. This has forced me to look at my items and COA again.