I was talking to my finisher today and somehow we got on this subject. He said they don't charge tax because they offer a service which is apparently not taxable. I however sell a manufactured product and therefore ....?

I dont have a resale license by the way. I was told it's too much trouble for a one man business.

From contributor St

Chris, your last sentence is troubling. If you are just doing this as a hobby, you are (not really) free to decide what is too much trouble.

Sales tax laws are very specific, and also vary from one state to the next. Any tax advise you get on this web site should be ignored entirely. While I don't manufacture, I'm required in my business to collect sales tax. We try to be very conscientious and compliant.

A year ago, I was subjected to a sales tax audit. Part of my customer base is represented by the types of businesses here. We didn't have all of the proper documentation for tax exempt declarations and I found out that whether I collected tax or not, I was responsible to pay that tax to the state. It cost me over $12,000 for the businesses that said they were tax exempt when they shouldn't be. Most of these we either took their word for it, or they said they would send a certificate after the sale, which they never did. With all of the states really strapped for cash, sales tax enforcement has increased in most states. If you think it's too much trouble to collect tax, imagine how much trouble it may be to come up with 6% or 8% of your last 3 years sales and send that to the government!

Please call your accountant or lawyer and get the correct advise for where you live. It's better to spend a little effort being compliant then lose everything, imho.

From contributor St

Oh, and by the way ....

I was also required to pay the sales tax on "wages" I paid to our contract cleaning lady because cleaning SERVICE is taxable - at least in Pennsylvania. So your finisher might not be the best source of tax information either.

From contributor Ri

Steve gives very good advice. You MUST speak to a local accountant to get appropriate counsel on this issue. Preferably one experienced in your industry. I pay sales tax on materials bought locally and use tax on materials and hardware purchased out of state. Items I sell that are clearly accessories I also pay sales tax on the retail price, even though I usually include the tax in the price. But that is approved by my CPA accountant.

As Steve has mentioned the consequences can be severe.

From contributor Ke

In Texas my cpa tells me if it is residential and my cabinets are installed and become part of the home, no tax on labor, but yes on materials. If it is commercial, tax on labor as well. On furniture, Tax on everything. I would not suggest guessing, because it's to much trouble. lol

From contributor Ch

I just love how the state gets paid.

Raw materials are cut down of fabricated into sheets and otherwise.....and we are taxed for this effort.

A guy takes raw materials and turns them into a product more valuable than the raw materials.

Somebody installs the fabricated raw materials.

How many times do you suppose the same bits of fiberous material gets taxed when humans touch it?

From contributor ch

Fun stuff! Let me clarify. I have to pay tax on materials (not exempt...I forget what that piece of paper is called. Thats what I meant about its too much trouble.) I'll ask my cpa...again. Im in CA now , before in NC, before that NH, before that WA. All are different I guess.

Thanks

From contributor Ma

Check with your state's department of revenue. In my state I pay sales tax on the materials, I build the cabinets and install them so if it's considered "real property improvement" meaning the cabinets are a permanent fixture of the business or residence and add to the property value then I do not need to charge sales tax. If it's something like a dresser or entertainment center then I do.

From contributor No

Chris,

I'm in CA and when I do my quarterly sales taxes, I break down my sales as follows: Resale (not taxable), Labor only (not taxable), installed cabinets (tax on material portion only), and final products like furniture (taxed on full amount).

Your finisher is basically correct in that roughly 100% of his service is labor. You don't charge sales tax on labor in CA.

From contributor Pa

My two finishers cost me about $120,000 last year, and the finish they sprayed cost more than $70,000. I question whether the entire bill you pay to the finisher goes to labor. And I second the recommendation to get advice from an accountant. Your finisher is no source for tax advice.

From contributor Al

We do a fair amount of work out of state and are constantly checking sales tax rules of different states.

Tax on cost of materials is common on installed goods, tax on everything but setup is common on freestanding or items sold to end users.

Most contract laws don't let you sell and install to designers in a single contract to install as most of them aren't licensed to contract

Items that maintain their identity in a product can be bough resale and you pay the tax latter, items that lose their identity are taxable. Items that maintain their identity are things like screws, melamine top coat.

Items that lose their identity or are consumed are things like thinner, cleaners

Tax law is different by state and everyone's advice to get professional advice is the best.

A-

From contributor No

Paul,

How does this work in PA? You're finisher charges you sales tax on his materials, and then you resell your table and charge sales tax again? Isn't this what the resale exemption is to avoid?

From contributor Ki

The basic idea is that the State wants to tax the largest dollar, but is not able (at least as of yet) to tax the same thing at several levels in the manufacturing.

That is, they want the last seller - the retailer - to collect tax for them on the table. This then exempts you - the seller - from paying tax on the materials and labor in the table, and exempts the lumber seller and hardware seller from charging you tax, since you provide them with an exemption form.

Most states tax the finished product as a whole - no breaking down of materials (taxed) and labor(often not taxed in most states). This gets them the most dollars, if you think like a politician.

The State gets you to be their tax collector and as a result of the agreement you sign to get a retail license to sell things, you assume the responsibility of paying the gov't those taxes. Same with payroll taxes, and soon to be health insurance. This is called the freedom to start a business, and is why we fight wars overseas, to preserve this freedom, among others.

From contributor Ec

"The State gets you to be their tax collector and as a result of the agreement you sign to get a retail license to sell things, you assume the responsibility of paying the gov't those taxes. Same with payroll taxes, and soon to be health insurance. This is called the freedom to start a business, and is why we fight wars overseas, to preserve this freedom, among others."

Literally LOL. Funniest thing ever written by Kilgore on this board, and he's written some funny things.

"This is called the freedom to start a business" reminds me of something written by Robert Heinlein of science fiction fame, also funny in the same dry way:

Throughout history, poverty is the normal condition of man. Advances which permit this norm to be exceeded here and there, now and then are the work of an extremely small minority, frequently despised, often condemned, and almost always opposed by all right-thinking people. Whenever this tiny minority is kept from creating, or (as sometimes happens) is driven out of a society, the people then slip back into abject poverty. This is known as bad luck.

Back on topic, all of the advice to get professional advice on sales taxes (not to mention many other things) is right on the money. Something being "too much trouble for a one man business" is not an acceptable excuse to any sales tax authority in the country.

The really bad downside to getting it wrong is that some states can and will take what they might deem to be a willful disregard of the law and triple the amounts they determine you owe as a penalty. And they're gonna want all of the money you owe them and they're gonna want it now. What might seem to be a matter of owing 6 or 7 or 8% of a given year's sales might turn out to be 18 or 21 or 24%.

Guessing or taking advice from people who are not tax professionals is not a road you should go down.

From contributor Pa

My finishers are my employees, so this isn't an issue for me. The point I was making is that finishing isn't just a service - there is actual material involved, and it's not cheap. So I don't buy the "just a service" argument. But my opinion doesn't count for much compared to your state's regulatory authority.

From contributor Ch

@ Economic 101,

Can you rephrase you comments about

Heinlien?

I want it to be clear you are either fan of Marxism or a fan of Free Market Capitalism.

My first guess is your handle may be an oxymoron.

Our founders fought against a 3% tax.

Its time our nation does so again.

From contributor Ch

I live in another country so much of what I say will have no bearing but...

My supplier buys raw material and pays tax on it. When I buy the material I also pay tax.

After I produce something with the material I sell it to my customer and he also pays 18% VAT on the item.

At tax time I get to deduct the tax I paid from the tax I collected and if I bought more than I sold I get a refund so it's really the end user that has paid the tax.

I assume that it works the same for you.

Chaim

From contributor Ch

@ Chaim,

Everything you said has bearing.

End Users are everybody's bread and butter. Without demand, where would any of us be?

In America, just over half pay no income tax. Unconstitutional entitlements are paid by the fruit of the labor of the remaining work force.

The wealthy, the movers, the shakers, the inventors, the builders, the creators, et al are demonized here as not paying their fair share but the opposite is true.

The accrual of taxation for every positive act of creation makes the purchasing of products, goods and services beyond the capacity of the very people we rely on.

Uncontrolled and unconstitutional spending by governments the world over impoverish the people they represent.

It's a proven fact, less taxation puts more money in government coffers as people spend less time trying to hang on to what they've earned.

At the end of a days labor, government demands on our creativity, our risk, our talent, our vision, our experience often exceed our ability to produce. The recent housing and financial collapse is a prime example.

I recently built a very nice shop two years ago. I'm penalized financially by our government for this effort. They seek to control, monitor and limit everything I do. If I were to build the same shop today, the cost of materials have trebled. Incomes have stayed the same.

A train wreck is coming. Out of control government spending, rules, regulation and an agenda seeking to kill our free market economy killing the foundation of our country.

I'm of the belief this is by design.

Any who profit by the fruit of their labor are preyed upon by the state.

Our fight, our right and our ability to thrive without government assistance makes us criminals as we cannot possibly comply to the letter of the law.

Chris's thread starter comment: "I was told it's too much trouble for a one man business." ... is spot on! It is to much trouble for all of us unless we are on the dole!

From contributor No

Chuck,

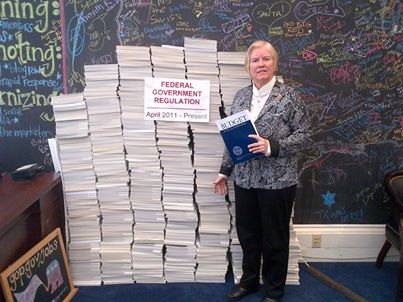

You know that stack of paperwork is printed double spaced in large font and is single sided. And that woman is a 4' hobbit. She never even read the laws. Instead she dropped acid, picked up some colored chalk, and 8 hours later she looks so confused because she has no idea what she just wrote on the chalkboard.

From contributor ka

My understanding ,in California ,if you do not have a CSCL you cannot legally install cabinets or fabricate on site.You therefor cannot meet the 90/10 fabrication rule ,making all your work (sales) taxable.

Below is the link with the information.

From contributor Ch

@ chuck

I don't mind paying taxes, I understand that in order for our Governments to function they need revenue.

What I do mind however is how the government looks to our money as theirs by right and not as a grant of power from the people.

If I choose to pay taxes is it because I approve of the governments use of that money?

where is the oversight and commitment to use that tax money in an fiscally responsible manor?

There sometimes seems to be no accountability to the people.

Yes I get to vote once every four years or so but the checks and balances just keep getting overlooked at election time.

I will pay taxes but I want my hard earned money to count for more than some bureaucrats easy payday.

Chaim

From contributor Mi

Help,

I have been in this business many years, and have never charged sales tax on the contract value with any firm that I have been with. The problem is that I cannot find anything to support this to show to my new employer that is new to this business. does anyone know which section of the mass tax code that speaks to this? No builders will enter into an agreement with me if I am charging sales tax and my employer is mandating that I either show them the tax code or charge sales tax.

your help will be greatly appreciated!!!!

From contributor Fe

I will advise never take such important decisions based on forums answers! Because the consequences are too high to risk like that...Years ago, when I started my small business, I did the mistake to trust all the documentation to a friend (kind of he told me that he has enough knowledge)...well everything was fine until our first audit. They have found a small mistake related to employer taxes and we have got such a fine... I have worked 2 months to cover it. So now, all my documentation related to taxes goes through https://taxfyle.com/ . My company takes orders from many states, and as everything is different, I can not risk to work basing on the same principles with each client.